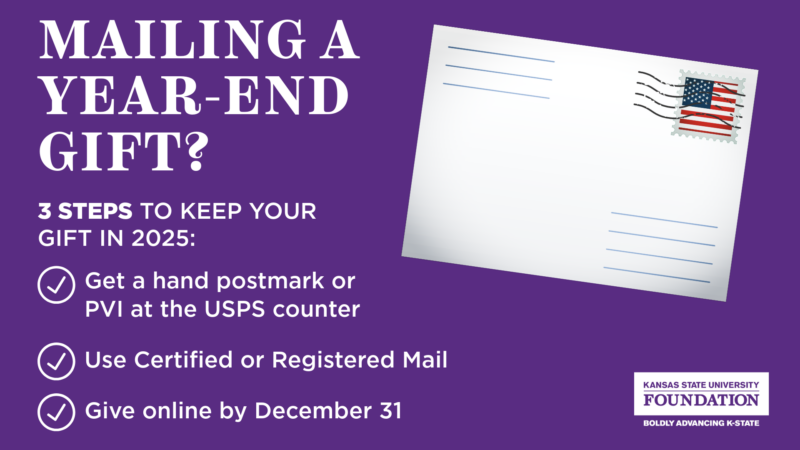

New USPS postmark practices could affect your 2025 tax deduction.

If you’re mailing a check and need it to count in 2025

- Go to the USPS retail counter and request a manual (hand) postmark dated the day you mail, or pay for postage at the counter to receive a postage validation imprint (PVI) showing the acceptance date.

- Use certified or registered mail (or purchase a certificate of mailing) to obtain a dated receipt proving mailing by Dec. 31.

- Avoid blue collection boxes and self-service kiosks for last-minute mailings; those items are typically postmarked later at a processing center.

Faster ways to give by Dec. 31

- Give online by 11:59 p.m. (your local time) on Dec. 31 — the charge date is the gift date.

- If you live in Manhattan, deliver a check in person to KSU Foundation headquarters, 1800 Kimball Ave., Suite 200 (2025 gift date when received by a KSU Foundation representative).

- For stocks, wire/ACH or IRA qualified charitable distributions (QCDs), timing depends on when funds/shares are received or when the IRA custodian distributes — please initiate early.

Important: Private delivery services (e.g., UPS, FedEx) do not provide USPS postmarks; checks sent by private carriers are generally dated when received by the charity.

Questions?

Contact us at foundation@ksufoundation.org or 833-448-3578

KSU Foundation does not provide tax, legal or accounting advice. Please consult your professional advisor about your circumstances.