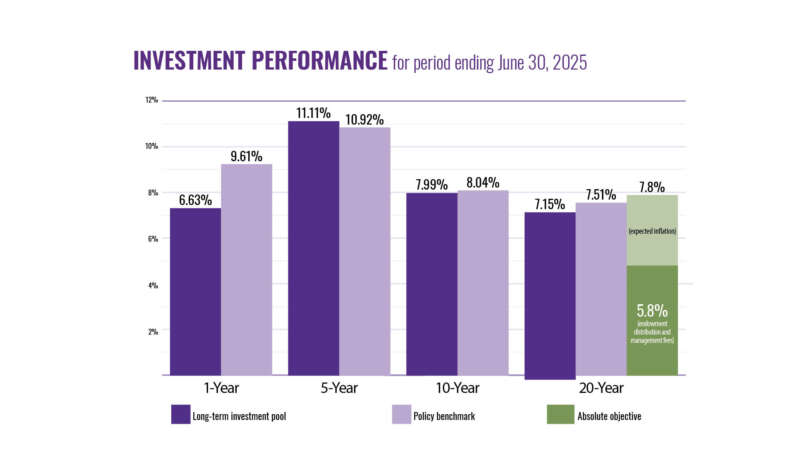

Our performance has ranked in the top quartile among 800+ college/university endowments and foundations.

Ranked among the best

Kansas State University Foundation’s long-term performance ranks in the top 10% of 600+ college/university endowments and foundations in 3- and 5-year net returns, and in the top half of all reported institutions for 10-25 years, according to the National Association of College and University Business Officers (NACUBO).

The fund targets a long-term return, offsetting distribution for philanthropic purposes and supporting growth of the endowment over time.

Annual fiscal year returns

| 6/30/2025 | 6.63% |

| 6/30/2024 | 8.82% |

| 6/30/2023 | 1.76% |

| 6/30/2022 | 5.72% |

| 6/30/2021 | 35.67% |

| 6/30/2020 | 2.60% |

| 6/30/2019 | 6.80% |

| 6/30/2018 | 9.15% |

| 6/30/2017 | 8.64% |

| 6/30/2016 | -1.93% |

Contact the investments team

Paul Chai, CFA, CAIA Vice President of Investments/CIO

785-775-2000

ksufinv@ksufoundation.org

Dylan Zheng Assistant Director of Investments

785-775-2000

ksufinv@ksufoundation.org

Matt Smagacz, CFA, FRM Director of Investments

785-775-2000

ksufinv@ksufoundation.org

Janessa Nelsen Investment Operations Analyst

785-775-2000

ksufinv@ksufoundation.org